Publish Date

September 19, 2023

Social Share

Well, it’s almost that time of year again. Year-end, that is.

As it inches closer, you may be finding unused and available funds in your use-it-or-lose-it budget. Most will wait until the last minute, scrambling in the last month, and week even, to make their purchases. But, you may want to start early this year, especially if you’re hoping to purchase work vehicles or equipment with them.

Use-it-or-lose-it budgets: What are they, and how do they work?

According to RingCentral, having a “use-it-or-lose-it budget means that if you don’t spend the total budget during the time in which it is allocated, you lose access to the unspent funds.”

Which doesn’t sound so bad, right? After all, you aren’t using the funds this year. But that doesn’t mean you won’t need that same amount, or more, to cover your expenses next year.

Well, unfortunately, instead of being rewarded for being a good steward, you might actually be penalized with a reduced budget in the following fiscal year. To avoid this, those with use-it-or-lose-it budgets try to spend any remaining amounts down, “proving” they need those full allocations… Cue the Q4 spending frenzy.

This year, spend smarter.

Often times, those last-minute Q4 purchases don’t align with what you and the business need. It’s just whatever’s available. And, if you want to break that cycle with new vehicles or equipment, you’re going to want to start looking soon.

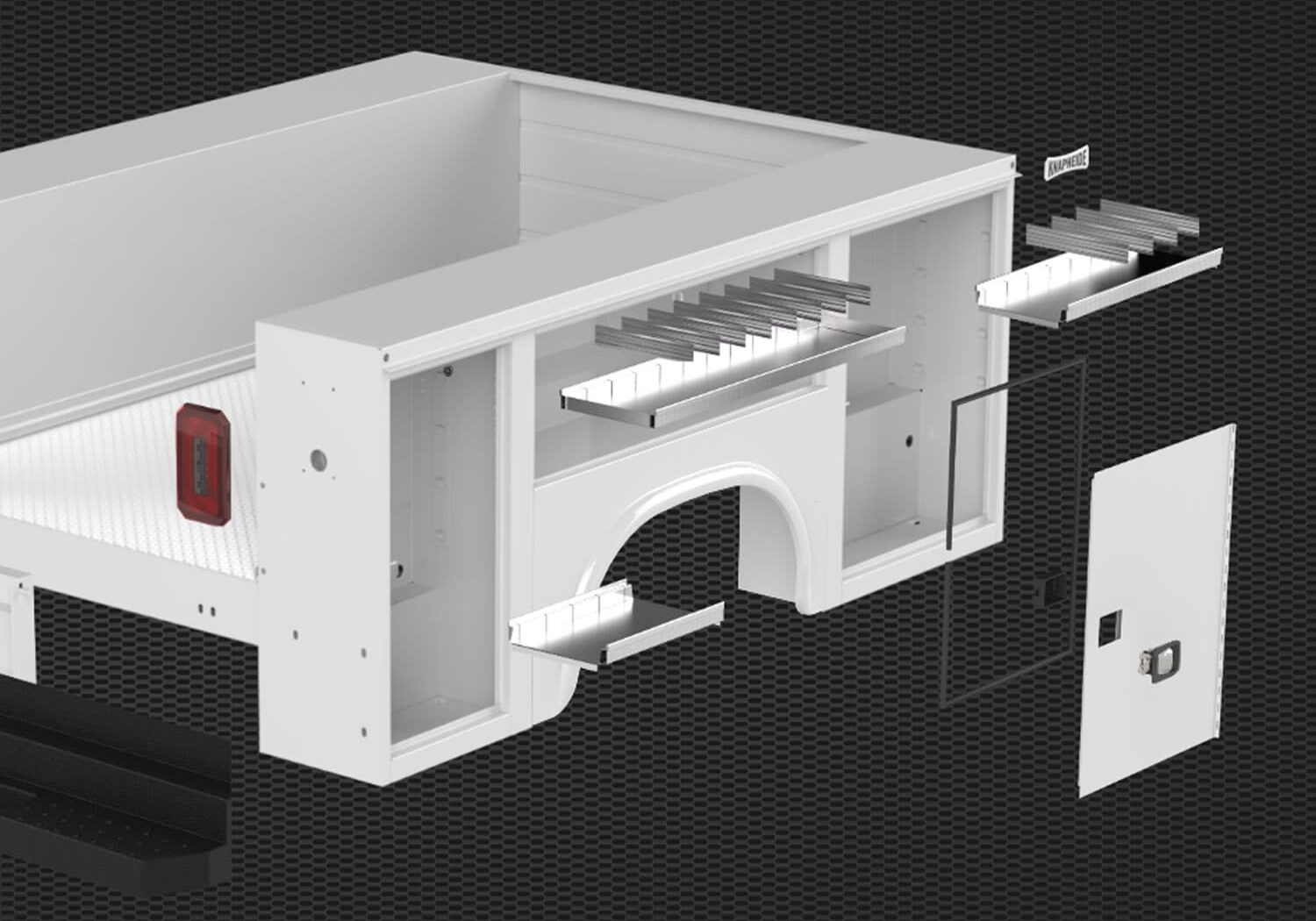

“Ideally, with current chassis, body and upfitting lead times, people should have started placing orders for year-end spending back in June,” Mandar Dighe, Vice President of Sales and Marketing at Knapheide, said. “But, the next best time to start is now. To avoid problems, you should start working with dealers and upfitters today. You may find upfitted vehicles on dealer lots or be able to take advantage of open build slots at the OEMs or upfitters, due to canceled orders.”

The longer you wait to connect with a dealer though, the less likely you’ll be able to find and purchase what you’re looking for by the end of the year. And, that end-of-year timeframe is important for more than just your budget.

By hitting the Dec. 31 deadline, you might also find that you’re eligible for tax deductions (or at least the business is). But, these tax benefits require that you purchase the vehicle AND place it in service this year. So, you’ll need to act quickly if you want to make the most out of the section 179 deduction and bonus depreciation*.

Getting Started

It’s important to remember that spending your use-it-or-lose-it budget is not just about getting rid of money or taking advantage of the tax benefits. It’s also about investing in the business and ensuring you and your team have the necessary tools and equipment to succeed in the upcoming year, and we want to help.

Locate a Knapheide dealer near you by clicking here.

*Other requirements may apply. Seek out a tax professional for a more thorough explanation of the eligibility guidelines.